Kód: 04771393

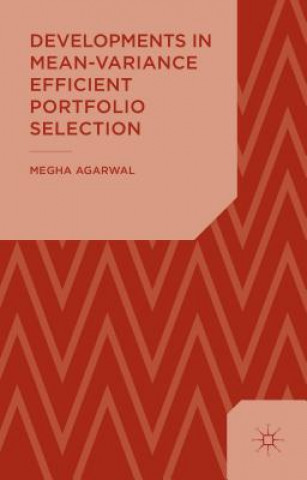

Developments in Mean-Variance Efficient Portfolio Selection

Autor Megha Agarwal

Mean-variance efficient portfolio selection was originally identified by Nobel Laureate Harry Markowitz (1952) and to this day remains one of the most popular approaches to portfolio selection. However the turmoil suffered by stoc ... celý popis

- Jazyk:

Angličtina

Angličtina - Vazba: Pevná

- Počet stran: 242

Nakladatelství: Palgrave Macmillan, 2014

- Více informací o knize

1542 Kč

Skladem u dodavatele v malém množství

Odesíláme za 10-15 dnů

Potřebujete více kusů?Máte-li zájem o více kusů, prověřte, prosím, nejprve dostupnost titulu na naši zákaznické podpoře.

Přidat mezi přání

Mohlo by se vám také líbit

-

Children's Literature Review

16264 Kč -

Chemical Formulary, Volume 9

2565 Kč -

Comparative Animal Physiology

18785 Kč -

Bass Guide Tips

309 Kč -

Cyprus

1122 Kč -

Court Martial Process

1680 Kč -

Companion to Pablo Neruda

877 Kč

Dárkový poukaz: Radost zaručena

- Darujte poukaz v libovolné hodnotě a my se postaráme o zbytek.

- Poukaz se vztahuje na celou naši nabídku.

- Elektronický poukaz vytisknete z e-mailu a můžete ihned darovat.

- Platnost poukazu je 12 měsíců od data vystavení.

Více informací o knize Developments in Mean-Variance Efficient Portfolio Selection

Nákupem získáte 154 bodů

Anotace knihy

Anotace knihy

Mean-variance efficient portfolio selection was originally identified by Nobel Laureate Harry Markowitz (1952) and to this day remains one of the most popular approaches to portfolio selection. However the turmoil suffered by stock exchanges as a result of the financial crises in the United States and later in Europe has evoked new interest across the globe for better portfolio management within the existing mean variance framework. Substantial improvements in the availability of large data sets, real time information and software capable of performing complex computations contributes towards improved research work in portfolio selection. Better understanding of the markets and evolving economic models provide the means to add further to modern portfolio theory. This book discusses a variety of new determinants for optimal portfolio selection. It reviews the existing modelling framework for portfolio selection developed by Markowitz, Sharpe, Fama and French and Ross and creates mean-variance efficient portfolios from the available pool of securities companies listed on the National Stock Exchange (NSE). The crucial role of portfolio attributes such as expected return, variance, the responsiveness of stock's index returns, market capitalisation, book-to-equity ratio and other such factors are identified in the creation of efficient portfolios. The resulting portfolios created using alternate portfolio selection model formulations are compared using the Sharpe and Treynor ratios. Quantitative and qualitative comparisons enable researchers to rank them in terms of their effectiveness in the present day Indian securities market. The mean-variance analysis undertaken in this book will be of immense use to individual and institutional investors, brokerage houses, mutual fund managers, banks, high net worth individuals, portfolio management service providers, financial advisors, regulators, stock exchanges and research scholars in the area of portfolio selection.

Parametry knihy

Parametry knihy

1542 Kč

- Plný název: Developments in Mean-Variance Efficient Portfolio Selection

- Autor: Megha Agarwal

- Jazyk:

Angličtina

Angličtina - Vazba: Pevná

- Počet stran: 242

- EAN: 9781137359919

- ISBN: 1137359919

- ID: 04771393

- Nakladatelství: Palgrave Macmillan

- Hmotnost: 446 g

- Rozměry: 144 × 218 × 19 mm

- Datum vydání: 11. November 2014

Oblíbené z jiného soudku

-

Common Stocks and Uncommon Profits and Other Writings

511 Kč -

House of Morgan

530 Kč -

Learn to Earn

390 Kč -

The Zurich Axioms

383 Kč -

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

451 Kč -

Security Analysis: The Classic 1940 Edition

1281 Kč -

Fooled by Randomness

288 Kč -

Market Wizards

566 Kč -

The Little Book That Still Beats the Market

522 Kč -

Options, Futures, and Other Derivatives, Global Edition

1871 Kč -

The Snowball

354 Kč -

Rule No. 1

283 Kč -

Where Are the Customers' Yachts? or A Good Hard Look at Wall Street

439 Kč -

Study Guide to Technical Analysis of the Financial Markets

854 Kč -

Naked Forex - High-Probability Techniques for Trading without Indicators

1370 Kč -

Candlestick Course

1302 Kč -

Intelligent Investor

633 Kč -

Beginner's Guide To Day Trading Online 2nd Edition

283 Kč -

New Market Wizards

396 Kč -

Reading Price Charts Bar by Bar - The Technical Analysis of Price Action for the Serious Trader

1399 Kč -

Tower of Basel

341 Kč -

Trade Your Way to Financial Freedom

758 Kč -

Value Investing - From Graham to Buffett and Beyond, Second Edition

711 Kč -

Art and Science of Technical Analysis - Market Structure, Price Action, and Trading Strategies

1828 Kč -

Trading Price Action Trading Ranges - Technical Analysis of Price Charts Bar by Bar for the Serious Trader

1638 Kč -

Little Book That Builds Wealth - The Knockout Formula for Finding Great Investments

506 Kč -

Trading Price Action Reversals - Technical Analysis Price Charts Bar by Bar for the Serious Trader

1353 Kč -

Daily Trading Coach - 101 Lessons for Becoming Your Own Trading Psychologist

850 Kč -

Paths to Wealth Through Common Stocks

483 Kč -

Contrarian Investment Strategies

683 Kč -

Bogleheads' Guide to Investing

515 Kč -

ETF Book, Updated Edition - All You Need to Know About Exchange-Traded Funds

680 Kč -

Trade Mindfully

1310 Kč -

Fibonacci Applications and Strategies for Traders

2116 Kč -

Excess Returns

1071 Kč -

Wealth, War and Wisdom

407 Kč -

Investors Quotient - The Psychology of Successful Investing in Commodities & Stocks 2e

1421 Kč -

The Alchemy of Finance

514 Kč -

Real Book of Real Estate

421 Kč -

Education of a Value Investor

718 Kč -

Reminiscences of a Stock Operator

483 Kč -

Trading Beyond the Matrix - The Red Pill for Traders and Investors

796 Kč -

The Dhandho Investor

683 Kč -

ABCs of Real Estate Investing

501 Kč -

Stan Weinstein's Secrets For Profiting in Bull and Bear Markets

449 Kč -

Complete TurtleTrader

332 Kč -

Most Important Thing Illuminated

637 Kč -

Alchemists: Inside the secret world of central bankers

283 Kč -

House of Rothschild

540 Kč

Osobní odběr Praha, Brno a 12903 dalších

Copyright ©2008-24 nejlevnejsi-knihy.cz Všechna práva vyhrazenaSoukromíCookies

Vrácení do měsíce

Vrácení do měsíce 571 999 099 (8-15.30h)

571 999 099 (8-15.30h)